* India is one of the most promising and developing marketplaces in the world. There is a great deal of desire among multinational corporations to take advantage of the consumer base in India and to enter the market first.

* Increasing purchasing power has led to growing demand.

* Nearly 60 shopping malls encompassing a total retail space of 23.25 million sq. ft are expected to become operational during 2023-25.

![]()

* Collective effort of financial houses and banks with retailers are enabling consumers to go for durable products with easy credit.

* Many global investors are investing in the retail sector either by buying a stake in existing assets or through greenfield development platforms.

* According to EY, E-commerce companies raised US$ 2.44 billion in PE/VC funding in 2023 from 85 deals, down from US$ 5.36 billion across 162 deals in 2022.

![]()

* Due to India’s wealth of resources, availability of labour at relatively low costs, and special investment wages such tax breaks, etc., foreign corporations prefer to invest here.

* Amazon is increasing its investment in India by US$ 15 billion over the next seven years, bringing its total investment to US$ 26 billion.

* India’s retail trading sector attracted US$ 4.63 billion FDIs between April 2000-March 2024.

* The retail sector in India accounts for over 10% of the country’s GDP and around 8% of the workforce (35+ million). It is expected to create 25 million new jobs by 2030.

![]()

* To improve the business climate and make it simpler for foreign companies to register fully owned subsidiaries in India, the Indian government has implemented a number of rules, regulations, and policies.

* 100% FDI allowed in single-brand retail under the automatic route.

* Liberalisation of FDI is expected to give a boost to Ease of Doing Business and Make in India.

![]()

Indian retail industry has emerged as one of the most dynamic and fast-paced industries due to the entry of several new players. It accounts for over 10% of the country’s gross domestic product (GDP) and around 8% of the employment. India is the world’s fifth-largest global destination in the retail space. India is the world’s fifth-largest global destination in the retail space and ranked 63 in the World Bank’s Doing Business 2023.

The sizeable middle class and nearly unexplored retail market in India are the main enticing factors for international retail behemoths seeking to move into newer markets, which will help the Indian retail business grow more quickly. The urban Indian consumer's purchasing power is increasing, and branded goods in categories like apparel, cosmetics, footwear, watches, beverages, food, and even jewellery are gradually evolving into business and leisure that are well-liked by the urban Indian consumer. The retail sector in India is expected to reach a whopping US$ 2 trillion in value by 2032, according to a recent analysis by the Boston Consulting Group (BCG).

India is one of the most promising and developing marketplaces in the world. There is a great deal of desire among multinational corporations to take advantage of the consumer base in India and to enter the market first. Nearly 60 shopping malls encompassing a total retail space of 23.25 million sq. ft are expected to become operational during 2023-25.

India ranks among the best countries to invest in Retail space. Factors that make India so attractive include the second largest population in the world, a middle-income class of ~158 households, increasing urbanization, rising household incomes, connected rural consumers, and increasing consumer spending.

As of December 2022, there were 7.8 billion daily e-commerce transactions. Online shoppers in India are expected to reach ~500 million in 2030 from 150 million in 2020. Online shoppers in India are expected to reach ~500 million in 2030 from +150 million in 2020. The E-Commerce market is expected to touch US$ 350 billion in GMV by 2030.

India’s retail sector was experiencing exponential growth with retail development taking place not just in major cities and metros, but also in small cities. Healthy economic growth, changing demographic profile, increasing disposable income, urbanisation, and changing consumer tastes and preferences have been some of the factors driving growth in the organised retail market in India.

To improve the business climate and make it simpler for foreign companies to register fully owned subsidiaries in India, the Indian government has implemented a number of rules, regulations, and policies.

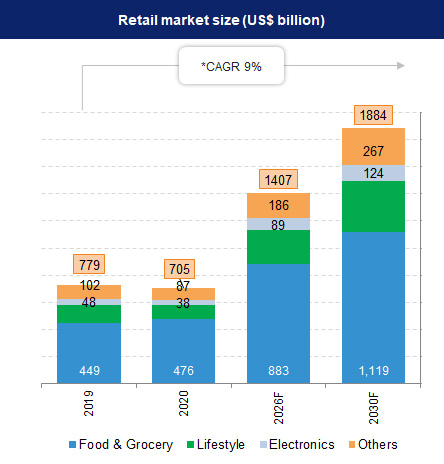

As per Kearney Research, India’s retail industry is projected to grow at 9% over 2019-2030, from US$ 779 billion in 2019 to US$ 1,407 billion by 2026 and more than US$ 1.8 trillion by 2030. India’s direct selling industry is expected to be valued at US$ 7.77 billion by the end of 2025. Despite unprecedented challenges, the India consumption story is still robust.

India has the third-highest number of e-retail shoppers (only behind China and the US). The new-age logistics players are expected to deliver 2.5 billion Direct-to-Consumer (D2C) shipments by 2030. Online used car transaction penetration is expected to grow by 9x in the next 10 years.

According to recent industry reports, the e-commerce industry witnessed a phenomenal 36.8% YoY growth in terms of order volumes. As consumers prefer to shop online throughout the year, this fast-changing consumer preference towards online shopping reveals the mature status acquired by e-commerce brands in India.

As of December 2022, there were 7.8 billion daily e-commerce transactions. Online shoppers in India are expected to reach ~500 million in 2030 from +150 million in 2020.

India’s digital economy is expected to touch US$ 800 billion by 2030, and the E-Commerce market is expected to touch US$ 350 billion in GMV by 2030.

The Retail sector in India has seen a lot of investments and developments in the recent past.

The Government of India has taken various initiatives to improve the retail industry in India. Some of them are listed below:

The COVID-19 pandemic has caused changes in consumer preferences, habits, and attitudes over the past few years. This has a significant impact on how people buy and consume goods and services. Global retailers are now using cutting-edge business strategies to take advantage of new retail opportunities. Consumers no longer distinguish between offline and online consumption channels. Due to this, major companies are experimenting with different ways to design seamless retail experiences that are integrated across all channels. By utilising both established e-commerce platforms and traditional techniques, retailers are also experimenting with revenue models to improve their customer value offer.

E-commerce is expanding steadily in the country. Customers have the ever-increasing choice of products at the lowest rates. E-commerce is probably creating the biggest revolution in retail industry, and this trend is likely to continue in the years to come. Retailers should leverage digital retail channels (E-commerce), which would enable them to spend less money on real estate while reaching out to more customers in tier II and tier III cities.

Online retail market in India is projected to reach US$ 350 billion by 2030 from an estimated US$ 70 billion in 2022, due to rising online shoppers in the country Nevertheless, long-term outlook for the industry looks positive, supported by rising income, favourable demographics, entry of foreign players, and increasing urbanisation.

Note: Conversion rate used in May 2024, Rs. 1 = US$ 0.012

References: Media Reports, Press Releases, Deloitte report, Department of Industrial Policy and Promotion website, Consumer Leads report by FICCI and Deloitte - October 2019, News Articles, KPMG Blogs